Interest rates on new mortgage loans

Fixed and variable rates in Luxembourg based on figures published by the BCL on Jan 5, 2026

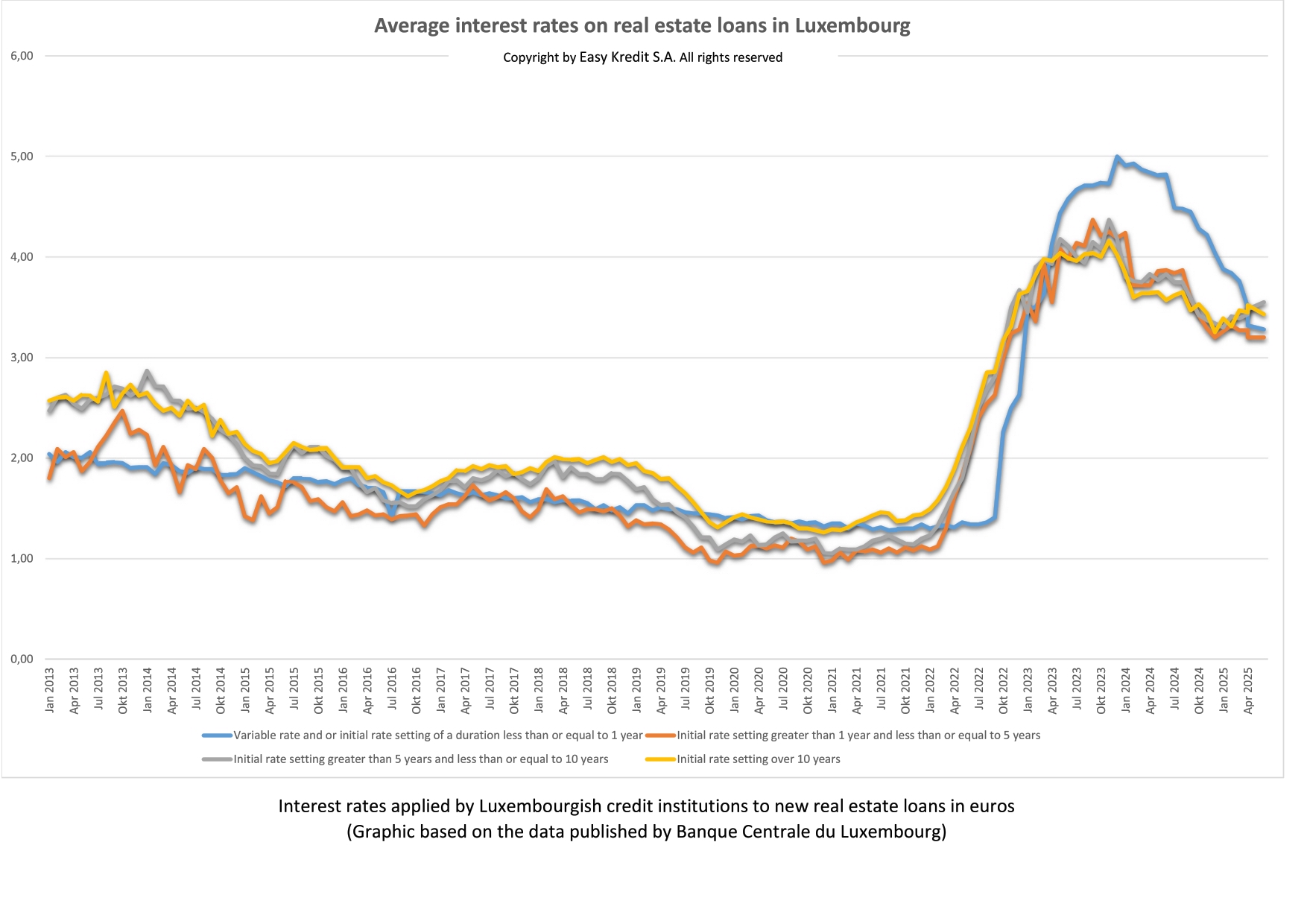

The following analyzes show the development of the interest rates on new mortgage loans in Luxembourg on Jan 5, 2026. The data on which these analyzes are based are updated on a monthly basis. They are based on figures from the Banque Centrale du Luxembourg (BCL).

The interest rates are divided into the following categories:

- Variable and fixed interest rate up to 1 year

- Fixed interest for more than 1 year up to 5 years

- Fixed interest rates for more than 5 years up to 10 years

- Fixed interest rates for more than 10 years up to 15 years

- Fixed interest rates for more than 15 years up to 20 years

- Fixed interest rates for more than 20 years up to 25 years

- Fixed interest rates for more than 25 years up to 30 years

- Fixed interest rate for more than 30 years

In general, the change in interest rates from one month to the next is very small. Although the figures from the Luxembourg Central Bank are always published with a delay of one to two months, they reflect the current market situation quite well and therefore enable you to estimate whether your interest rate corresponds to the current market situation.

Mortgage interest rates published by the BCL on Jan 5, 2026

| Duration of the fixed interest period | Current rate |

Change in one month |

|---|---|---|

| Variable interest rate and initial fixed interest rate for 1 year or less | 3.07% | -0.02% |

| Initial fixed interest rate for more than 1 year up to and including 5 years |

3.27% | -0.13% |

| Initial fixed interest rate for more than 5 years up to and including 10 years |

3.55% | -0.04% |

| Initial fixed interest rate for more than 10 years up to and including 15 years |

3.74% | -0.07% |

| Initial fixed interest rate for more than 15 years up to and including 20 years |

3.72% | -0.04% |

| Initial fixed interest rate for more than 20 years up to and including 25 years |

3.48% | -0.03% |

| Initial fixed interest rate for more than 25 years up to and including 30 years |

3.92% | +0.27% |

| Initial fixed interest rate for more than 30 years |

3.82% | +0.04% |

Current Trend of Mortgage Interest Rates

According to the latest figures published by the Banque Centrale du Luxembourg (BCL) on January 5, 2026, interest rates show a clear pattern: short- and mid-term fixed-rate periods are falling, while rates for long-term fixations – over 25 years – are on the rise.

The variable rate and fixations of up to one year decreased slightly by 0.02 percentage points to 3.07%. The most significant decline was seen in fixations of more than one up to five years, dropping by 0.13 points to 3.27%.

Other fixations also declined:

-

5–10 years: –0.04 (now 3.55%)

-

10–15 years: –0.07 (3.74%)

-

15–20 years: –0.04 (3.72%)

-

20–25 years: –0.03 (3.48%)

Fixations beyond 25 years, however, increased noticeably:

-

+0.27 points for fixations between 25 and 30 years (now 3.92%)

-

+0.04 points for fixations over 30 years (now 3.82%)

This indicates that securing short or mid-term rates is becoming more affordable, while long-term rate guarantees are becoming more expensive – an important consideration for borrowers focused on long-term stability.

Important NOTE:

Please note that these interest rates correspond to the interest rates recorded by the BCL. These reflect the actual market situation. However, the numbers are delayed by at least a month. Due to the current strong upward trend, you should therefore assume that your bank's interest rates can be significantly higher than the interest rates shown here.

Interest rates on real estate loans published by the BCL on Jan 5, 2026

We negociate your interest rate for you

Request an interest rate for your project

What interest rate can I expect for my financing?

Some banks adjust their interest rates weekly. Most banks also agree to negotiate interest rates. The interest rate that you can expect for your mortgage loan depends on whether you choose a fixed or variable interest rate and, if you choose a fixed interest rate, also on the duration of the fixed rate. So, we can only tell you what interest rate you will receive if we know all the details of your project. The best way to get an interest rate is to request a free quote. If you want that we can negotiate for you, the best interest with our partner banks, it is best to provide us with complete documents. In this way, we can best convey the quality of your project to our partner banks. A request for an offer for a mortgage loan is of course free of charge and non-binding.